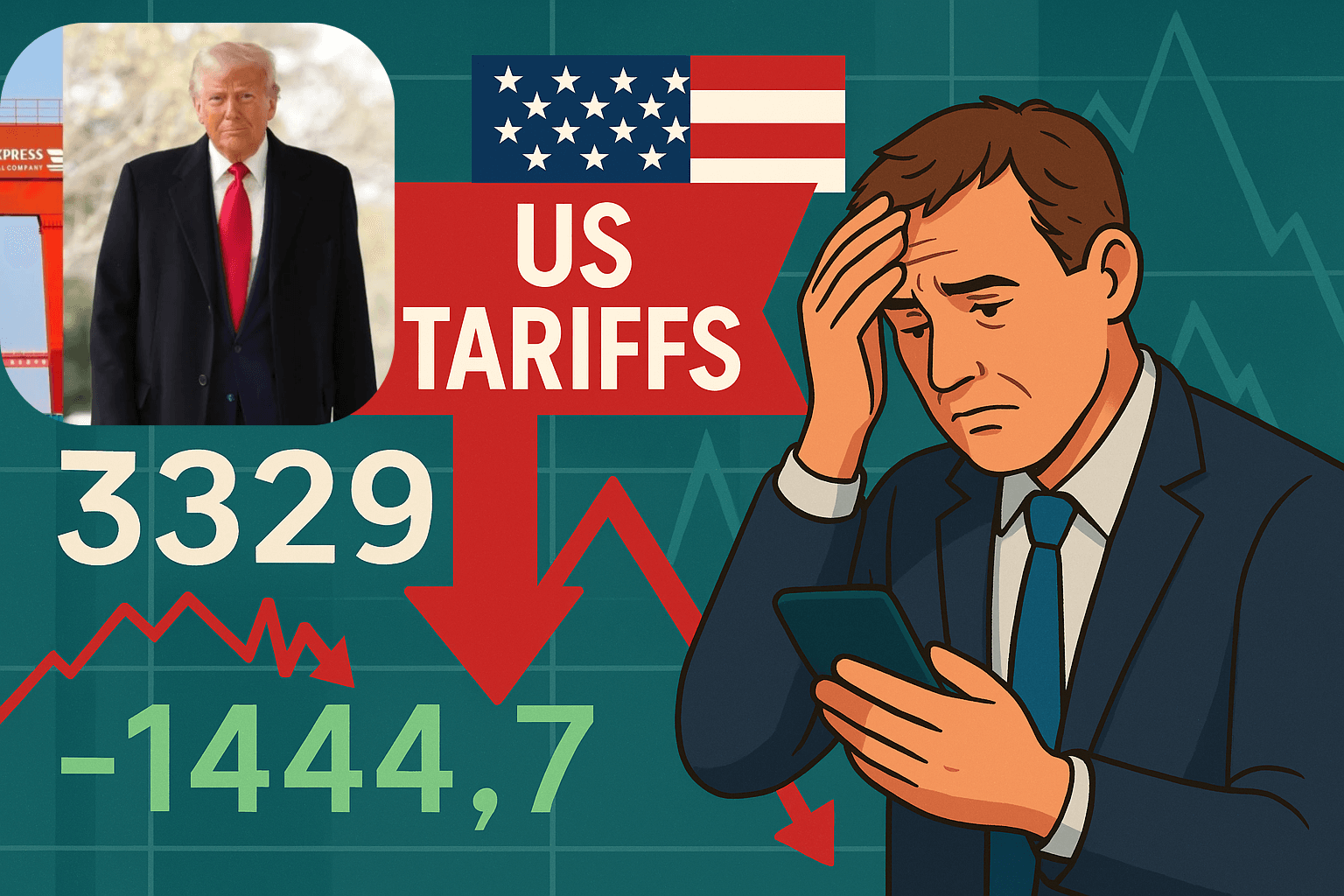

On April 2, 2025, U.S. President Donald Trump announced new tariffs, causing turmoil in stock markets worldwide. This decision has increased uncertainty among investors and raised fears of a global economic slowdown. On Wall Street, the Dow Jones Industrial Average dropped more than 1,600 points, while the S&P 500 and Nasdaq also recorded sharp declines.

Trump’s Tariffs: What Are the Changes?

In his “Liberation Day” speech, President Trump introduced a new trade policy reform, which includes:

A 10% baseline tariff on all imports, with exemptions for Canada and Mexico.

Additional tariffs ranging from 25% to 50% on imports from China, the European Union, Vietnam, and other countries.

The elimination of the “$800 de minimis rule” for online shopping and e-commerce imports, impacting companies like Amazon, eBay, and Temu.

A 25% tariff on non-American-made cars, potentially increasing the prices of foreign vehicles by up to $20,000.

When Will These Tariffs Take Effect?

The 10% baseline tariff has been effective since April 5, 2025.

Country-specific tariff rates will come into effect on April 9, 2025.

Impact on Stock Markets and the Global Economy

Following this announcement, a sell-off surged in stock markets as investors feared that higher import duties would make consumer goods more expensive, increase production costs for companies, and disrupt global trade.

Industries Most Affected

E-commerce sector: Shares of Amazon, eBay, and Temu fell by more than 5%.

Automobile companies: Stocks of BMW, Toyota, and Volkswagen declined sharply.

Fashion & Luxury Brands: Companies like Nike, Adidas, and LVMH may struggle with rising costs and weaker consumer demand.

IMF Warning: Risk of a Global Recession

The International Monetary Fund (IMF) has warned that if the U.S. continues its “protectionist trade policies,” global trade could slow down, inflation could rise, and the world might enter a recession.

What’s Next?

Investors are now watching the Federal Reserve and other central banks for their response. If the crisis worsens, there could be changes in interest rates to stabilize the market.

President Donald Trump’s aggressive trade policies have heightened uncertainty in global stock markets. Companies are reassessing their business strategies, and economists are warning of a potential recession. The biggest question now is: Are we witnessing the beginning of another trade war, or will global markets face an even bigger crisis in the coming years?

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always research and consult a professional before making investment decisions. The author and website are not responsible for any financial losses.

You May Also Like:- Glen Powell Addresses Sydney Sweeney’s Presence at His Sister’s Wedding, Romance Rumors Intensify